Table of Contents

Introduction to Exness Calculators

Exness offers a suite of powerful calculator tools designed to enhance trading precision for Pakistani investors. These calculators provide essential metrics for informed decision-making in forex and CFD markets. Traders can access profit, leverage, lot size, and margin calculators directly through the Exness platform. Each tool is tailored to address specific aspects of trading strategy and risk management. The Exness trading calculator utilizes real-time market data to ensure accuracy in calculations.

Exness Profit Calculator: Estimating Potential Returns

The Exness Profit Calculator allows traders to forecast potential gains from their positions. Users input currency pair, position size, entry price, and exit price to generate profit estimates. This tool factors in current spreads and swap rates for precise calculations. Traders can adjust leverage settings to see how different levels impact potential profits. The Exness Profit Calculator supports multiple account currencies for versatile planning.

Key Features of the Profit Calculator

- Real-time market data integration

- Support for all tradable currency pairs

- Customizable leverage settings

- Swap and spread inclusion

- Multi-currency support

Leveraging the Exness Leverage Calculator

The Exness Leverage Calculator helps traders understand the impact of leverage on their positions. Users can input their account balance, desired position size, and leverage ratio. The calculator then displays the required margin and available leverage options. Exness offers leverage up to 1:2000 for certain instruments, subject to regulatory limits. This tool is crucial for managing risk and avoiding margin calls.

Leverage Ratio | Margin Requirement | Position Size Multiplier |

1:100 | 1% | 100x |

1:500 | 0.2% | 500x |

1:1000 | 0.1% | 1000x |

1:2000 | 0.05% | 2000x |

Mastering Position Sizing with the Lot Size Calculator

The Exness Lot Calculator aids in determining appropriate position sizes based on risk tolerance. Traders input their account balance, risk percentage, and stop loss in pips. The Exness position size calculator then recommends a suitable lot size to maintain the desired risk level. This tool supports standard, mini, and micro lots for precise position sizing. Exness provides lot sizes as small as 0.01 lots, allowing for flexible risk management.

Benefits of Using the Lot Size Calculator

- Consistent risk management across trades

- Prevention of oversized positions

- Customization based on individual risk tolerance

- Support for multiple lot size types

- Integration with current market conditions

Optimizing Investments with the Exness Investment Calculator

The Exness Investment Calculator helps traders plan long-term strategies and compound returns. Users can input initial investment, monthly contributions, expected return rate, and investment duration. The calculator projects potential growth over time, accounting for compounding effects. Traders can adjust parameters to compare different investment scenarios. This tool is valuable for setting realistic long-term financial goals.

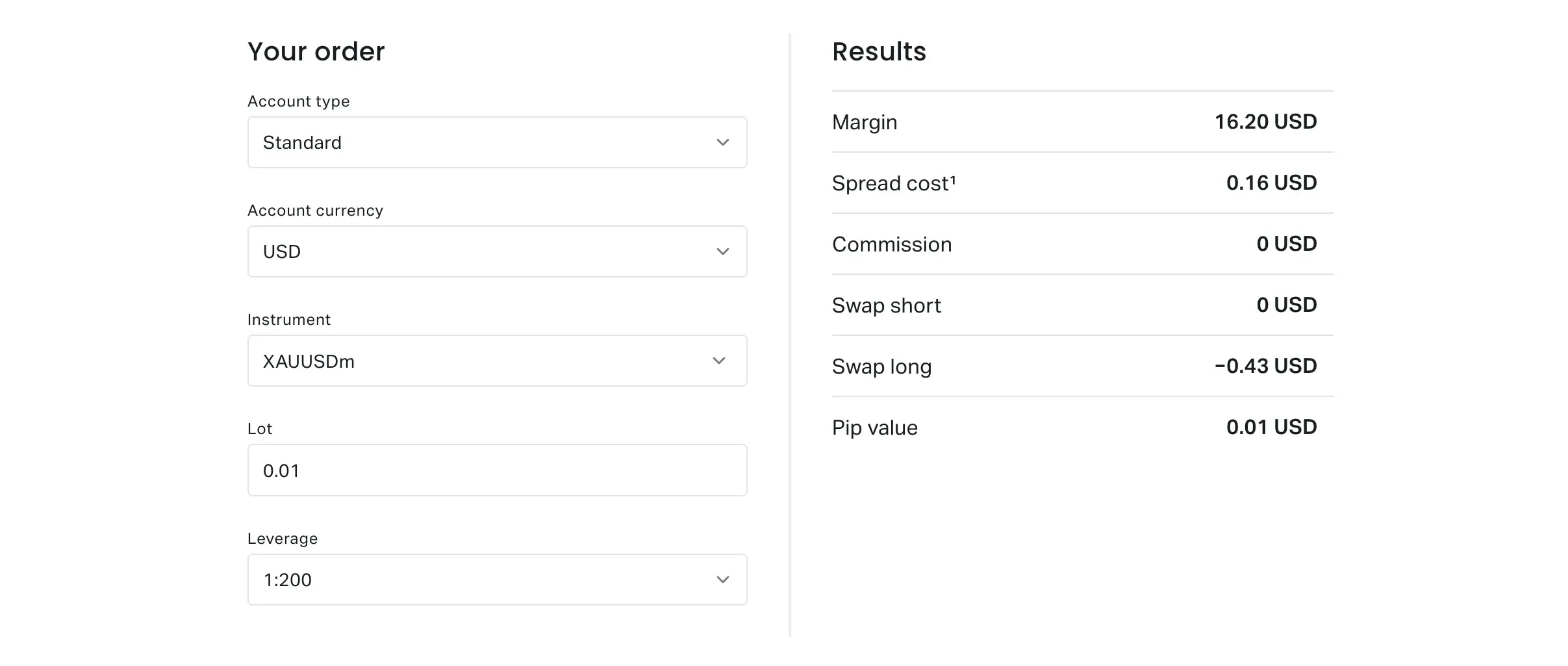

Streamlining Trade Analysis with the Exness Trade Calculator

The Exness trading calculator combines multiple functions for comprehensive trade analysis. It incorporates elements of profit, leverage, and lot size calculations into a single interface. Traders can input trade parameters and instantly see potential outcomes across various metrics. The tool displays profit/loss in both percentage and absolute terms. The Exness trading calculator supports all available trading instruments on the platform.

Integrated Features of the Trade Calculator

- Profit/loss projections

- Margin requirement calculations

- Swap cost estimates

- Break-even point analysis

- Risk-reward ratio display

Enhancing Risk Management with the Margin Calculator

The Exness Margin Calculator is essential for understanding margin requirements and avoiding margin calls. Users input their account currency, leverage, and position size to view required margin. The calculator displays free margin and margin level based on current account balance. Exness provides real-time updates on margin levels through the trading platform. This tool helps traders maintain adequate margin for open positions.

Account Balance | Leverage | Position Size | Required Margin | Free Margin |

$10,000 | 1:100 | 1 lot | $1,000 | $9,000 |

$10,000 | 1:500 | 1 lot | $200 | $9,800 |

$10,000 | 1:1000 | 1 lot | $100 | $9,900 |

Precision Trading with the Exness Pip Calculator

The Exness Pip Calculator converts pip movements into monetary values based on position size. Traders input the currency pair, account currency, lot size, and pip movement. The calculator then displays the corresponding profit or loss. This tool is crucial for understanding the financial impact of market movements. The Exness lot calculator supports fractional pip pricing for enhanced accuracy.

Applications of the Pip Calculator

- Setting precise stop loss and take profit levels

- Calculating potential slippage costs

- Evaluating the impact of economic news on positions

- Comparing pip values across different currency pairs

- Fine-tuning risk management strategies

Conclusion: Maximizing Trading Potential with Exness Calculators

Exness calculators, including the Exness trading calculator, lot calculator, and position size calculator, provide Pakistani traders with powerful tools for informed decision-making. From profit estimation to risk management, these calculators cover all aspects of trading strategy. Regular use of these tools can significantly enhance trading precision and performance. Exness continues to refine and expand its calculator suite to meet evolving trader needs. Traders are encouraged to explore and utilize these calculators to optimize their trading approach.

Farhad Mahmud

Financial Analyst. Over 7 years of experience in global financial markets, specializing in risk management and portfolio optimization. Holds a Master’s degree in Finance from the London School of Economics. Author of analytical articles on investment strategies and market trends.

Frequently Asked Questions (FAQ)

Exness calculators use real-time market data and account for current spreads and swap rates, ensuring high accuracy. However, actual results may vary due to market volatility and execution factors.

Yes, Exness calculators are available on both desktop and mobile platforms, allowing traders to perform calculations on-the-go.

No, all Exness calculators are provided free of charge to registered users as part of the platform’s comprehensive trading toolkit.