Table of Contents

Exness Account Types

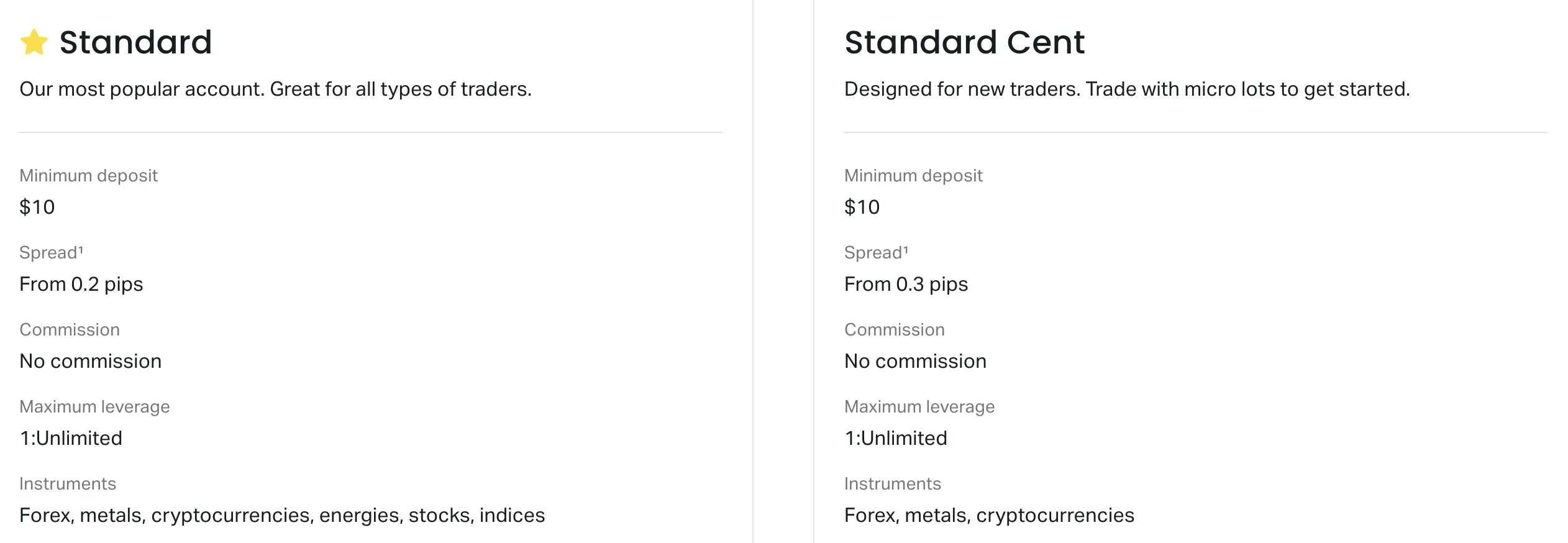

Exness, a leading forex and CFD broker, offers traders in Pakistan a range of account types to suit various trading styles and preferences. Understanding the different types of Exness accounts is crucial for maximizing your trading potential. Exness provides three main account categories: Standard, Pro, and Raw Spread. Each type has unique features, spreads, and leverage options. This comprehensive overview will help Pakistani traders make informed decisions when choosing among the various types of Exness accounts.

Standard Account: Ideal for Beginners

The Exness Standard Account is designed for novice traders and those seeking a straightforward trading experience. It offers competitive spreads starting from 1 pip on major currency pairs. Leverage options range from 1:1 to 1:2000, allowing traders to adjust their risk exposure. The minimum deposit requirement is just $1, making it accessible to traders with limited capital.

Key Features of Standard Account

- No commission on trades

- Instant execution of orders

- Access to over 120 trading instruments

- MetaTrader 4 and MetaTrader 5 platform support

- 24/7 customer support in Urdu and English

Here’s a detailed breakdown of the Standard Account specifications:

Feature | Specification |

Minimum Deposit | $1 |

Spread | From 1 pip |

Leverage | Up to 1:2000 |

Commission | $0 |

Execution Type | Instant |

Platform | MT4, MT5 |

Pro Account: For Experienced Traders

Among the types of Exness accounts, the Pro Account caters to more experienced traders seeking tighter spreads and advanced trading conditions. It offers raw spreads starting from 0 pips on major currency pairs, with a small commission per lot traded. This account type provides excellent conditions for scalping and high-frequency trading strategies.

Advantages of Pro Account

Pro Account traders benefit from:

- Tighter spreads compared to Standard Account

- Market execution with no requotes

- Higher leverage options, up to 1:2000

- Advanced risk management tools

- Ability to use expert advisors and algorithmic trading

Raw Spread Account: Institutional-Grade Trading

The Exness Raw Spread Account offers institutional-level trading conditions for professional traders and high-volume investors. This account type provides ultra-low spreads starting from 0 pips, with a slightly higher commission per lot compared to the Pro Account. It’s ideal for traders who prioritize precision in execution and minimal trading costs.

Raw Spread Account Highlights

- Lowest possible spreads

- Market execution with deep liquidity

- Supports all trading styles, including scalping

- Advanced charting and analysis tools

- Dedicated account manager for high-volume traders

Here’s a comparison of Pro and Raw Spread Account features:

Feature | Pro Account | Raw Spread Account |

Minimum Deposit | $500 | $1000 |

Spread | From 0 pips | From 0 pips |

Commission | $3.5 per lot | $5 per lot |

Leverage | Up to 1:2000 | Up to 1:1000 |

Execution | Market | Market |

Islamic Account Option

Exness respects the religious beliefs of Muslim traders in Pakistan by offering Shariah-compliant Islamic accounts. These accounts are available for all types of Exness accounts and feature swap-free trading. Islamic accounts ensure that no interest is charged or paid on overnight positions, adhering to Islamic finance principles.

Islamic Account Characteristics

Islamic accounts maintain the same trading conditions as their standard counterparts, with the following adjustments:

- No swap or rollover fees

- Slightly higher spreads to compensate for swap-free trading

- Limited holding time for positions to prevent abuse

- Available for all Exness account types

- Requires verification of Islamic faith

Exness Standard Vs Pro Account Comparison

When deciding between Exness Standard and Pro accounts, traders should consider their experience level, trading volume, and preferred strategies. The Standard Account is suitable for beginners with its straightforward pricing and lower minimum deposit. The Pro Account offers advantages for more active traders who require tighter spreads and can manage the additional commission structure.

Key Differences

- Spread: Standard accounts have wider spreads but no commission, while Pro accounts offer tighter spreads with a small commission.

- Minimum Deposit: Standard accounts require only $1, whereas Pro accounts have a $500 minimum.

- Execution: Standard accounts use instant execution, while Pro accounts utilize market execution.

- Target Trader: Standard is ideal for beginners, Pro for experienced traders.

- Trading Style: Standard suits long-term strategies, Pro is better for short-term and high-frequency trading.

Exness Standard Account Spread Details

The Exness Standard Account spread is a crucial factor for many traders. Spreads on this account type are variable, meaning they fluctuate based on market conditions. During normal market hours, spreads on major currency pairs typically range from 1 to 3 pips. However, during periods of high volatility or important economic news releases, spreads may widen temporarily.

Standard Account Spread Examples

Here are typical spread ranges for popular trading instruments on the Standard Account:

Instrument | Typical Spread Range |

EUR/USD | 1.0 – 1.5 pips |

GBP/USD | 1.5 – 2.0 pips |

USD/JPY | 1.2 – 1.8 pips |

Gold | 25 – 35 points |

US30 | 150 – 200 points |

Choosing the Right Exness Account Type

Selecting the appropriate type of Exness account depends on various factors, including trading experience, capital, strategy, and risk tolerance. Consider these aspects when making your decision:

- Trading Volume: Higher volume traders benefit more from Pro and Raw Spread accounts.

- Strategy: Scalpers and day traders may prefer Pro or Raw Spread for tighter spreads.

- Capital: Choose an account type that matches your available trading funds.

- Experience: Novice traders should start with Standard accounts before progressing.

- Risk Management: Consider leverage options and their impact on your trading risk.

Conclusion

Exness offers a diverse range of account types to cater to traders of all levels in Pakistan. From the beginner-friendly Standard Account to the professional-grade Raw Spread Account, there’s an option for every trading style. By understanding the features, spreads, and conditions of each account type, Pakistani traders can make informed decisions to enhance their forex and CFD trading experience with Exness.

Farhad Mahmud

Financial Analyst. Over 7 years of experience in global financial markets, specializing in risk management and portfolio optimization. Holds a Master’s degree in Finance from the London School of Economics. Author of analytical articles on investment strategies and market trends.

Frequently Asked Questions (FAQ)

Yes, Exness allows traders to switch between account types. You can request a change through your personal area or by contacting customer support.

Exness does not charge inactivity fees on any of its account types. Your account will remain active as long as you maintain a balance.

Exness implements strict security measures, including segregated client accounts, encryption technology, and compliance with international financial regulations to protect trader funds.